Shares of publicly listed broker Plus500 (LSE: PLUS) initially dropped 4% in response to the latest

trading update, but later rebounded to close at a record level of 3,070 pence

during Monday’s session. Analysts at Peel Hunt, commenting on the fintech’s

preliminary Q1 2025 results, noted the increasing “quality” and “value” of both

new and active retained customers.

Peel Hunt

also raised their target price for Plus500 shares to 3,400 pence, implying a

potential upside of around 11.5%.

Plus500’s

latest trading update showed Q1 revenues were 13% higher than in the previous

quarter, reaching $206 million, while quarterly EBITDA rose 23% to $94 million.

Although the number of active and new customers dipped compared to last year,

customer value metrics improved, with both average revenue per user and average

deposits rising.

At the

Monday open, shares initially fell 4% to 2,930 pence, but rebounded by the

session’s close to finish at 3,070 pence, up 0.72% on the day. The intraday

high was 3,094 pence, setting a new all-time high (ATH). On Tuesday, April 29,

2025, shares again reached a new ATH at 3,098 pence.

Source: Yahoo! Finance

According

to Peel Hunt analysts Stuart Duncan and Stephen Payne, this is only the

beginning. In their updated “Buy” recommendation issued Monday, they raised the

target price for Plus500 from 2,910 pence to 3,400 pence.

Peel Hunt Sees Further

Gains Possible

Peel Hunt

noted that Plus500 continues to perform above market consensus, with the firm’s

own EBITDA forecast for the full year already running ahead of published

consensus estimates. The analysts cited the strength of Plus500’s business

model and its ongoing cash generation, with the group holding approximately

$885 million in balance sheet cash.

Despite the

stock’s strong rally, Plus500 still trades at a price-to-earnings ratio of

about 11.8 times 2024 earnings, and an EV/EBITDA multiple close to 6x,

according to Peel Hunt data. The dividend yield is projected at 4.2% for 2024.

“The group

remains highly cash generative,” said Peel Hunt’s Duncan and Payne. “We see

further upside potential despite the recent strong share price performance.”

Plus500 has

also expanded its geographic reach, with a recent acquisition in India, and its

non-OTC business now accounting for 12% of total revenue. The next scheduled

trading update from the company is due in July.

In addition to its Indian expansion, Plus500 obtained a new regulatory license in the UAE from the Securities and Commodities Authority in January, allowing it to enhance its local product offerings. The company also launched a multi-asset offering for the Japanese retail market comprising new OTC products based on indices, equities, and ETFs.

2025 and 2026 Forecasts

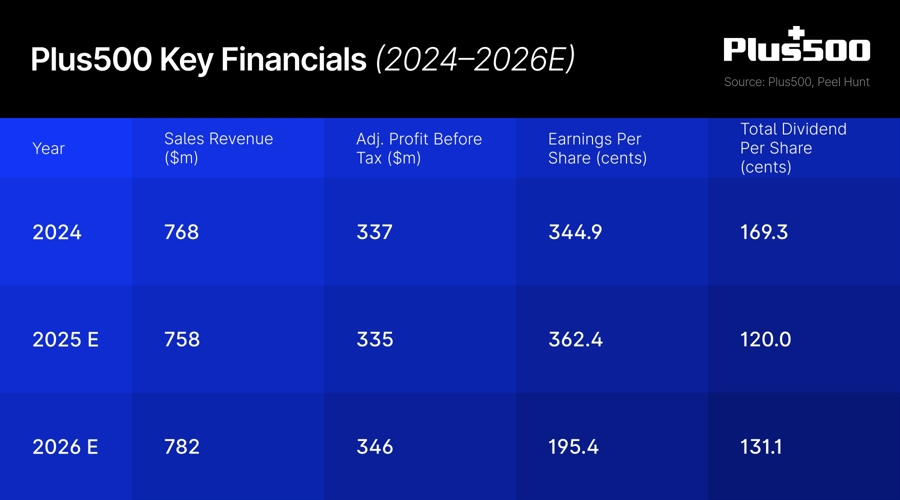

For 2025,

revenues are expected to reach $758 million, with adjusted pre-tax profit

forecast at $335 million and adjusted earnings per share at 362.4 cents. EBITDA

is projected at $341.4 million, supporting strong free cash flow of $292.4

million. Peel Hunt also notes a significant cash balance, with net cash

expected to rise to $882 million by year-end 2025.

Looking

ahead to 2026, the outlook remains positive. Peel Hunt anticipates revenue

increasing to $782 million, adjusted pre-tax profit rising to $346 million, and

adjusted earnings per share reaching 395.4 cents. EBITDA is forecast to rise to

$353.5 million, and net cash is set to approach $983 million, with free cash

flow estimated at $305.2 million.

“The

overall conclusion of the statement is that the full-year results should be

ahead of consensus,” Peel Hunt added. “The company website cites consensus

EBITDA of $331m; we are already slightly ahead of this at $341m, so make no

changes, and expect consensus to settle closer to our forecast.”

In terms of

valuation, Plus500 is currently trading at a forward price-to-earnings ratio of

11.2 times for 2025, dropping to 10.3 times for 2026. The enterprise value to

EBIT multiple is forecast at 6.0x for 2025 and 5.1x for 2026. Dividend yield is

projected at 2.9% for 2025 and 3.2% for 2026.

Shares of publicly listed broker Plus500 (LSE: PLUS) initially dropped 4% in response to the latest

trading update, but later rebounded to close at a record level of 3,070 pence

during Monday’s session. Analysts at Peel Hunt, commenting on the fintech’s

preliminary Q1 2025 results, noted the increasing “quality” and “value” of both

new and active retained customers.

Peel Hunt

also raised their target price for Plus500 shares to 3,400 pence, implying a

potential upside of around 11.5%.

Plus500’s

latest trading update showed Q1 revenues were 13% higher than in the previous

quarter, reaching $206 million, while quarterly EBITDA rose 23% to $94 million.

Although the number of active and new customers dipped compared to last year,

customer value metrics improved, with both average revenue per user and average

deposits rising.

At the

Monday open, shares initially fell 4% to 2,930 pence, but rebounded by the

session’s close to finish at 3,070 pence, up 0.72% on the day. The intraday

high was 3,094 pence, setting a new all-time high (ATH). On Tuesday, April 29,

2025, shares again reached a new ATH at 3,098 pence.

Source: Yahoo! Finance

According

to Peel Hunt analysts Stuart Duncan and Stephen Payne, this is only the

beginning. In their updated “Buy” recommendation issued Monday, they raised the

target price for Plus500 from 2,910 pence to 3,400 pence.

Peel Hunt Sees Further

Gains Possible

Peel Hunt

noted that Plus500 continues to perform above market consensus, with the firm’s

own EBITDA forecast for the full year already running ahead of published

consensus estimates. The analysts cited the strength of Plus500’s business

model and its ongoing cash generation, with the group holding approximately

$885 million in balance sheet cash.

Despite the

stock’s strong rally, Plus500 still trades at a price-to-earnings ratio of

about 11.8 times 2024 earnings, and an EV/EBITDA multiple close to 6x,

according to Peel Hunt data. The dividend yield is projected at 4.2% for 2024.

“The group

remains highly cash generative,” said Peel Hunt’s Duncan and Payne. “We see

further upside potential despite the recent strong share price performance.”

Plus500 has

also expanded its geographic reach, with a recent acquisition in India, and its

non-OTC business now accounting for 12% of total revenue. The next scheduled

trading update from the company is due in July.

In addition to its Indian expansion, Plus500 obtained a new regulatory license in the UAE from the Securities and Commodities Authority in January, allowing it to enhance its local product offerings. The company also launched a multi-asset offering for the Japanese retail market comprising new OTC products based on indices, equities, and ETFs.

2025 and 2026 Forecasts

For 2025,

revenues are expected to reach $758 million, with adjusted pre-tax profit

forecast at $335 million and adjusted earnings per share at 362.4 cents. EBITDA

is projected at $341.4 million, supporting strong free cash flow of $292.4

million. Peel Hunt also notes a significant cash balance, with net cash

expected to rise to $882 million by year-end 2025.

Looking

ahead to 2026, the outlook remains positive. Peel Hunt anticipates revenue

increasing to $782 million, adjusted pre-tax profit rising to $346 million, and

adjusted earnings per share reaching 395.4 cents. EBITDA is forecast to rise to

$353.5 million, and net cash is set to approach $983 million, with free cash

flow estimated at $305.2 million.

“The

overall conclusion of the statement is that the full-year results should be

ahead of consensus,” Peel Hunt added. “The company website cites consensus

EBITDA of $331m; we are already slightly ahead of this at $341m, so make no

changes, and expect consensus to settle closer to our forecast.”

In terms of

valuation, Plus500 is currently trading at a forward price-to-earnings ratio of

11.2 times for 2025, dropping to 10.3 times for 2026. The enterprise value to

EBIT multiple is forecast at 6.0x for 2025 and 5.1x for 2026. Dividend yield is

projected at 2.9% for 2025 and 3.2% for 2026.