Bitcoin (BTC) whales are back in action, selling the cryptocurrency in significant volumes. This surge in selling pressure coincides with BTC’s return to $100,000, raising concerns about its ability to maintain this key threshold.

If this happens, then the numerous predictions that Bitcoin could surpass move close to $125,000 could be delayed.

Bitcoin Big Wigs Have Refrained from HODLing

Data from IntoTheBlock reveals that Bitcoin’s large holders netflow — a metric tracking the net buying or selling by addresses holding over 1% of the circulating supply — has shown notable changes over the past week. A week ago, the netflow stood at 28,570 BTC when Bitcoin’s price was $97,885.

However, the situation has shifted. As of now, the netflow has dropped to -3,960 BTC. At Bitcoin’s current price of $100,954, this negative netflow translates to approximately $400 million in sales by whales.

This suggests a significant increase in selling pressure among large Bitcoin holders. If sustained, this could drive the BTC price lower in the coming days.

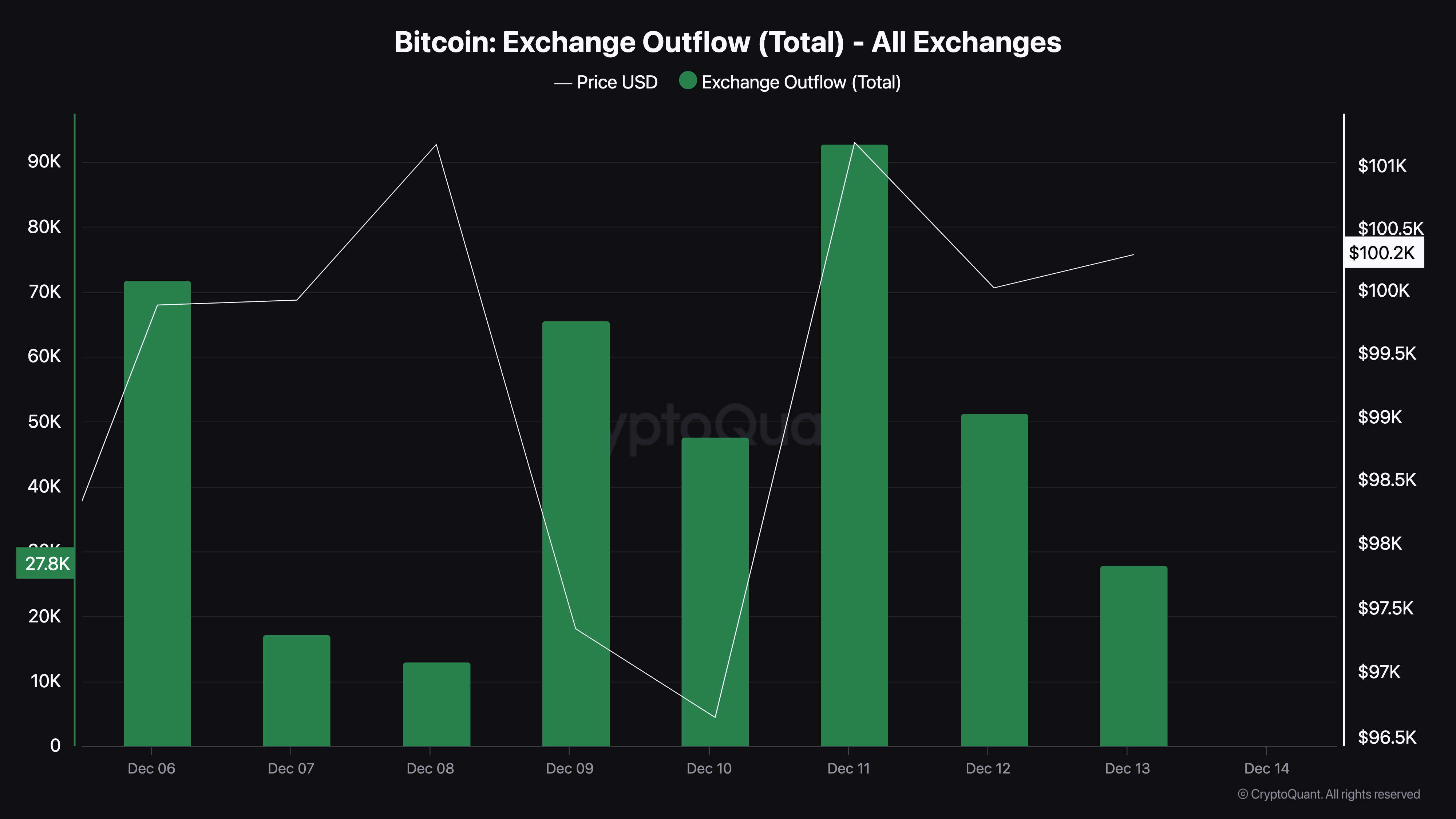

The total Bitcoin exchange outflow supports this thesis. Exchange outflow measures the number of coins sent from centralized platforms to external self-custody wallets. When the metric rises, it means that most holders do not plan to sell.

However, a decrease implies that the rate of HODLing has fallen, which could negatively affect the price. According to CryptoQuant, the Bitcoin exchange outflow has decreased from the peak it reached on December 11. Should this decline continue, the Bitcoin’s price could be on the verge of slipping below $100,000 again.

BTC Price Prediction: Is $91,000 Looming

Based on the daily BTC/USD chart, the Moving Average Convergence Divergence (MACD) has dropped to the negative region. The MACD measures momentum with positive values indicating a bullish condition, while a drawdown indicates otherwise.

Therefore, this decline indicates that Bitcoin’s price rebound to $100,000 might not last. In this case, the likely price region for BTC to hit could be around $91,918. If the market condition gets extremely bearish and Bitcoin whales’ selling pressure intensifies, it could drop to $80,437.

However, if buying pressure increases, Bitcoin price might climb above the $101,173 resistance. In that scenario, the cryptocurrency could rally toward $108,000.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.